USDA Qualifications Map: Make sure a message or Place

So it representative-amicable map allows you to quickly determine if your own wished place qualifies to own an excellent USDA Loan, beginning doorways so you’re able to affordable financial support options and a satisfying existence into the your perfect neighborhood.

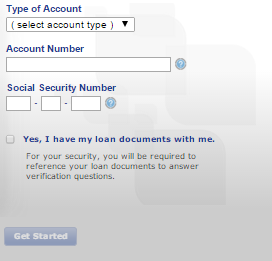

The way you use the brand new DSLD Financial USDA Funding Eligibility Chart

Playing with the chart is easy! Only enter in brand new target of the property you’ve discover, and the map often instantly make suggestions whether or not it falls contained in this an excellent USDA-eligible urban area. Components emphasized when you look at the purple is actually ineligible, when you find yourself section in the place of red shading qualify to own USDA Funds. It is that facile to get going in your road to homeownership.

What exactly is an effective USDA Loan?

A great USDA Mortgage, supported by the united states Institution away from Agriculture, are an authorities-insured mortgage designed specifically for lower- so you’re able to moderate-income homebuyers from inside the eligible rural portion. USDA Loans render multiple advantages that make homeownership significantly more obtainable, including:

- No advance payment requirements : USDA Fund normally don’t need an advance payment, easing this new economic weight of getting property.

- Low interest : USDA Money normally have competitive interest rates, and make monthly payments economical.

- Flexible borrowing requirements : USDA Funds be a little more lenient which have credit scores versus Old-fashioned Financing, beginning doorways to a greater list of customers.

- Shorter financial insurance policies: USDA Loans enjoys all the way down mortgage insurance fees than other mortgage types. Continua a leggere