Migrants Version relating to Variety

Inclusion The term Abrahamic Religions refers to Judaism, Islam, and Christianity, which get their spiritual supply from common origins. Predicated on Lovat and you will Crotty (2015), new social, geographic, ethnic, and historical experiences of these trust assistance hails from brand new Close Eastern. The three is monotheistic and you can rely on certain distinct.

Polls: Self-Wanting Samples during the News

Studies and polls was indispensable units to own evaluating public-opinion towards the new critical points throughout the day. As a result, its unsurprising that mass media often believe in those individuals systems to own recommendations. Sadly, surveys is actually naturally more likely to statistical mistakes that will distort the fresh public-opinion truth that they.

Already, migration is set besides because the an excellent socio-economic, and also unambiguous socio-psychological, ethnographic, and political sensation. Variation during the a great migration condition is challenging because of the a lot off factors that affect this course of action, particularly weather, social, societal, linguistic, cultural differences, the latest facilities of brand new social contacts, unavoidable.

- Interaction

- Cinema

- Tech

- Food

- Deals

- Psychology

And also make Swells: The skill of Movie Sound

Now, the fresh sound recording is actually part of the movie business. It is hard to assume watching a film instead of experiencing the fresh new dialogues anywhere between letters. In movies where conversations are left down, certain music are acclimatized to place the air of the world. It report have a tendency to.

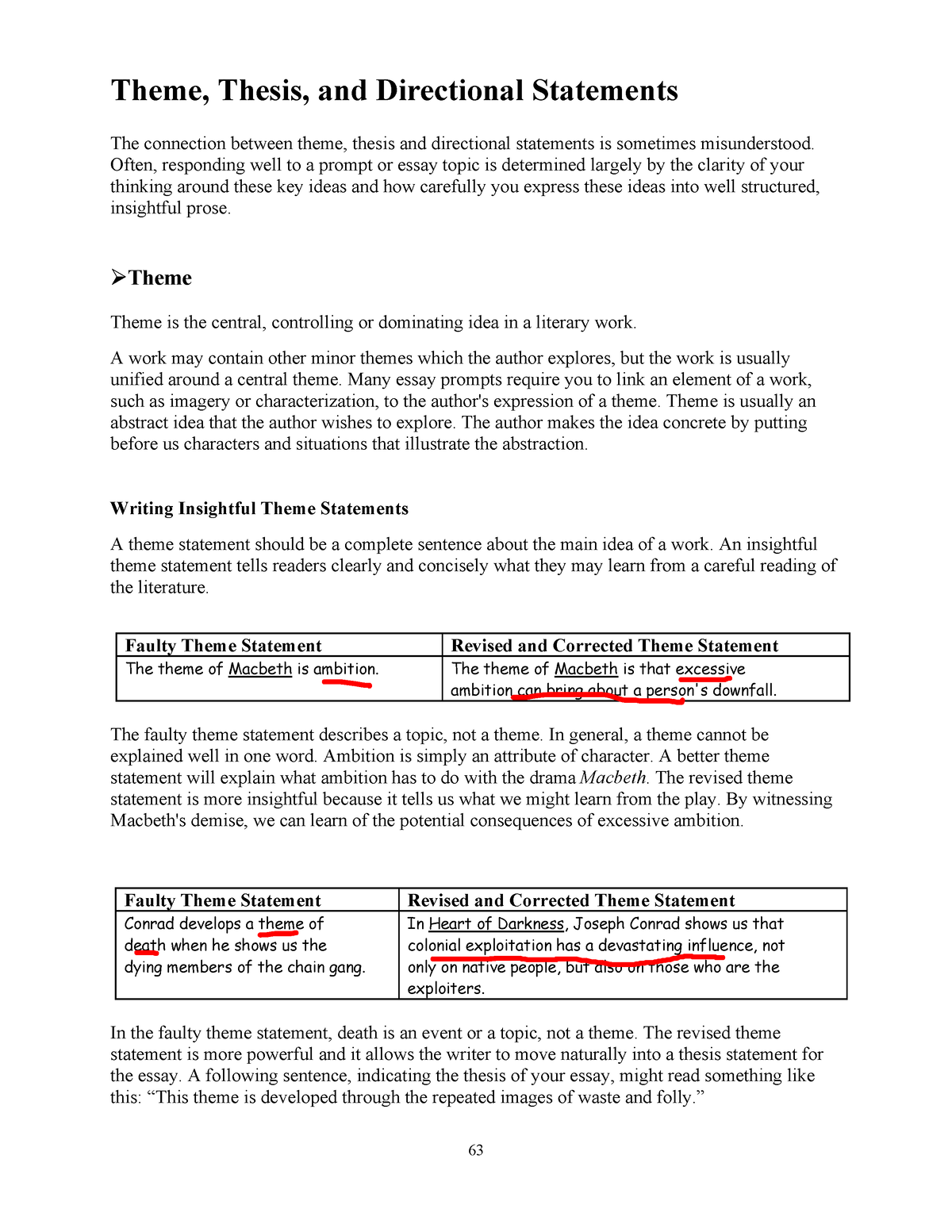

The ability of Battle by the Sunrays Tzu against. Othello of the Shakespeare

Classics was literature that are considered the latest gage and fundamental area from site due to their time otherwise a certain style. In try this site earlier times, that it title known particular article writers of old literature, and soon after it actually was always reference all the ancient greek language and you can Roman books. Continua a leggere