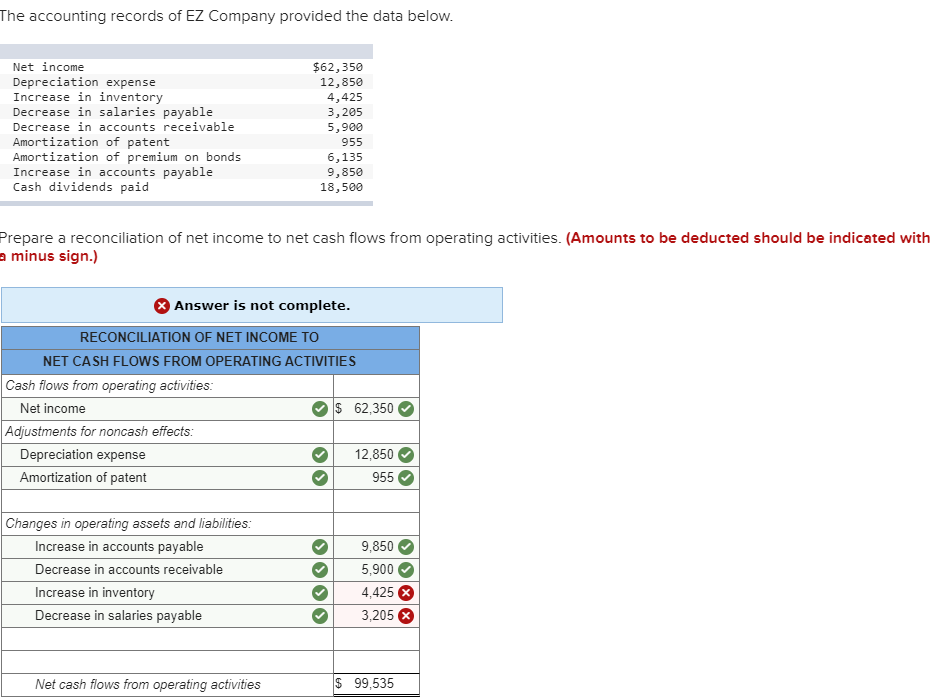

The financing relationship and you may financial costs testing because of the NCUA suggests the fresh new yearly and you will quarterly averages to have financing and you will expenses

FDIC compared to. NCUA

Together with a credit union’s security measures or that from a neighbor hood or federal lender, one or two big government play a crucial role for the guaranteeing your own tough-acquired money – new Federal Deposit Insurance rates Enterprise (FDIC) while the National Borrowing Commitment Management (NCUA). Based whether or not you choose a card union or bank, you will find that your dumps is actually covered by that or additional:

Banks: Really antique finance companies is covered from the FDIC put insurance coverage , and therefore assures the deposited financing up to $250,000 and you will covers you if there is a financial incapacity.

Borrowing unions: Borrowing unions are included in NCUA , and this acts much like the fresh new FDIC and offers deposit insurance up to help you $250,000 to guard you should your borrowing commitment fails. The fresh new NCUA assures every federal and many condition borrowing from the bank unions, and with ease browse a card relationship toward official NCUA web site.

Just who Profits?

As credit unions aren’t-for-earnings, they may be able render its people on the finest interest levels and you will reasonable charge in lieu of prioritizing profits.

Shareholders very own banking companies, which are having-funds communities. They aim to provide enticing pricing so you can customers if you are looking to peak margins to optimize earnings. You’ll likely see less navigate to this site advantageous interest rates and financial fees when you are possibly experiencing down support service.

Customer support

Borrowing from the bank unions can offer a greater run personalization and better quality services as compared to financial institutions since they’re affiliate-centric and you will focus on the requirements of its membership, which is all their associate-customers.

No matter if banking institutions provide outstanding provider, the services tends to be a lot more standard and less individual. While doing so, banking institutions will work at large business and you will/or commercial financing to maximize profits, and therefore they cannot sharpen within the to their private membership holders’ service and you may tool standards such borrowing unions create.

Interest levels

Credit unions tend to provide higher returns to their deposit monetary things if you’re providing noticeably straight down interest charge. The latest 2023 evaluation suggests credit unions bring noticeably higher mediocre prices into the permits of put (CD) and cash field membership.

During that monetary season, financial institutions provided highest prices to your offers profile and you may examining accounts, no matter if this varies. Furthermore, financial institutions had a tendency to costs highest rates to own handmade cards, each other the and you may used car money, fixed-rates mortgages, or other mortgage functions.

Society Engagement and you can Regional Impact

A small regional financial part, with most of their readers and account holders regarding close city, may wish to brand name in itself given that common regional bank and you will, thus, features a financial extra to purchase your regional area.

On the other hand, borrowing from the bank unions is definitely vested in local community wedding as well as the somebody enabling some one thinking. All of the credit unions servers an annual credit union meeting to generally share important information making use of their representative-owners. Borrowing from the bank unions partner with regional organizations so you can uplift, engage, and enhance nearby neighborhood and its own players. Specific borrowing unions supply training programs to add extra really worth on their members and area.

Signup Blue Eagle Borrowing from the bank Commitment Today

Why financial which have a cards relationship? As you are entitled to good four-star sense that simply has a credit commitment that provides modern conveniences and you will an individual touching.

In the Bluish Eagle Borrowing Union , i serve the greater number of Roanoke and you will Lynchburg, Virginia components, focusing on specific metropolises and you will areas , plus Altavista, Amherst Condition, Appomattox Condition, Bedford Condition, Botetourt State, Campbell Condition, Craig County, Franklin County, Roanoke Urban area and you may Roanoke Condition, Lynchburg Town, Salem, and also the city of Vinton. Generate a scheduled appointment to open membership from the one of our places and take benefit of the virtual properties to talk about debt ambitions and you may provider means.