Simple tips to Financing Multifamily Property that have good Virtual assistant Loan

The current Coronavirus pandemic departs enough questions about the brand new affect the true estate ily expenses could offer a great reprieve out-of monetary disturbance the real deal home investors. This is because multiple-household members functions promote quicker risk due to having multiple device.

A good number of people don’t learn-is that you can pick multi-friends functions which have good Va Mortgage. It’s an incredible opportunity for knowledgeable people or even very first-day homebuyers, so be sure to cannot admission it!

Multifamily House Research and Studies

When you find yourself researching services to shop for, see your own will cost you! The home loan repayments include dominant, desire, fees, and you may insurance policies, but that is not all the you really need Andalusia loans to think. It’s important to include factors such as resources, projected restoration can cost you, vacancy, capital expenditures, and property administration. With multiple unit means a rise in all of this type of!

You should know their potential rents. It will help you (and your bank) determine if it’s an excellent get. Venue is a huge cause for rental wide variety, so make sure you research towns and cities.

Very first, to finance a multiple-relatives assets with a beneficial Va financing, the debtor must inhabit one of the equipment inside two months off closing. This is actually the same rule one to pertains to unmarried-nearest and dearest land. Even though you have to survive the house, an opportunity is dependent on leasing from leftover equipment to fund their home loan repayments.

When there is one to veteran borrower, the house or property are only able to keeps to five equipment. Therefore, if perhaps you were thinking about carrying out good Va financing for an effective 100-equipment apartment complexthat’s not it is possible to, but there is a method to increase the amount of gadgets. That with a joint Virtual assistant Financing, several pros can purchase property to one another. Since it is a couple of consumers, the new Virtual assistant makes it possible for half dozen total devices. Including five residential units, one business product, and another product that is shared possession.

For every single standard, the latest Virtual assistant requires the assets in order to meet minimal possessions criteria to feel financed. These minimal assets criteria ensure that the home is safe and livable. One requirements would be the fact for every unit have to be personal and accessible. Mutual liquids, sewer, gas, and you may energy try ok considering:

- The house or property has actually independent provider closed-offs for every device.

- There are easements/covenants protecting liquid contacts and you may Va approves of this agreement.

- Ensure the tools provides lawfully protected use of resources to possess solutions (although it’s passageway through other livings places).

- Mutual places eg washing and you will shops are permitted because of the Va.

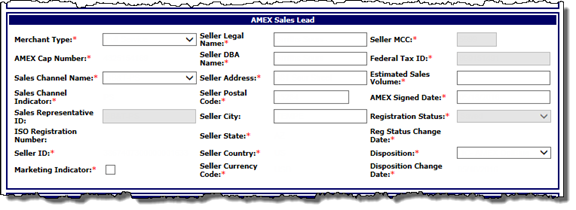

Va Application for the loan Processes for buying Multifamily

Although processes will be like playing with a beneficial Va loan for purchasing just one-house, you can find distinctions. Instead of unmarried-family, the new Va enables local rental income out-of unused products as sensed, but you need to confirm:

- That you, the newest debtor, are a skilled property owner/manager using one of them standards:

- You’ll want had multifamily in past times.

- You have got earlier sense dealing with multifamily.

- You have got earlier in the day feel meeting possessions apartments.

- You were in the past useful people assets part.

Once you have considering relevant records to prove one of several above spots, brand new Va have a tendency to incorporate 75% away from coming local rental earnings to your full income attention. To make use of upcoming local rental income, finalized leases must be in place ahead of closing the loan.

Most other Factors When purchasing Multifamily Property having a Virtual assistant Mortgage

As the cost of a multiple-device inspection may be enticing to successfully pass toward, borrowers need to have an evaluation done towards assets throughout the escrow. Having an inspection offers details about people complications with this new possessions, that may help you create the best decision in your pick and may assistance to rates/bargain discussion.

Making use of your Va loan to acquire a multiple-friends property is good begin or introduction for the using journey. Once you Pcs to some other obligation route, you could potentially rent out most of the units to produce more funds. You could quickly create your collection and also have reduced economic exposureit is an earn-winnings!

Kelly Madden are an atmosphere Push lover already stationed from the Yokota Abdominal, Japan possesses been partnered so you’re able to their own great husband, Steeped, having thirteen ages. This woman is as well as mother to 3 breathtaking girls Ava, Lexi, & Evie. A licensed Florida agent (currently toward advice status), she and her spouse very own three rental qualities in Crestview, Fl and generally are performing for the cracking toward multifamily stadium. Kelly likes to invest their own big date working as an online secretary, volunteering once the a button companion to have 5AF, and horse riding.