Advantages and disadvantages regarding an FHA 203k financing

A lender normally let you know in the event the a house you’re interested in qualifies, and just how far you’ll likely be eligible in order to acquire. You can then begin the application form procedure and begin protecting contractor bids with the structured home improvements.

Remember: You will need an extensive company to keep your loan on the right track. Initiate searching for you to early on, and also all of them get started on the things they’re doing estimates right while the you might be preapproved to suit your loan.

Just after they’ve got accomplished the newest offers and you can filed ideal papers, you could potentially outline a final financing documents, romantic, and get happening your repairs.

Just like any financial device, FHA 203k money possess advantages and drawbacks. Let’s see both sides of your money.

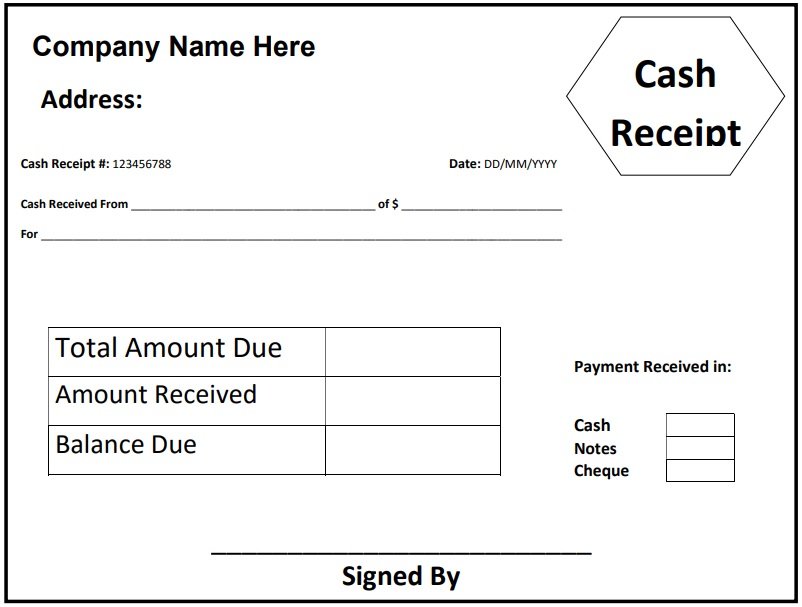

ProsConsCan help you funds property buy and fixes which have you to definitely unmarried loanMore challenging finance that will take longer to help you closeMinimal off payment required (step three.5% if for example the credit history was 580 or more)Not absolutely all loan providers provide themAllow you to definitely build equity quicklyComes that have an initial and you may yearly Financial Premium

New FHA repair loan has many rewards, but definitely look at the drawbacks, also. Remodeling a home can loans in Hayward be enjoyable, nonetheless it may also feel a huge horror should you choose unsuitable specialist otherwise unforeseen facts arise inside repairs.

When do you want an excellent HUD-approved 203k agent?

An excellent 203k agent is essentially a venture manager getting 203k fixes. It make it easier to file suitable files and keep assembling your project and you may mortgage focused while you’re remodeling.

You certainly do not need a consultant to locate acknowledged to own an effective limited 203k financing. But if your framework finances is more than $thirty five,000 or if you want to create architectural solutions hence you need a basic 203k mortgage, just be sure to focus on good HUD-accepted 203k associate. All the practical 203k commands need experts.

To obtain an effective 203k agent, you could ask your financing administrator having a resource otherwise search HUD’s databases to have specialists in your area.

FHA 203k loan Faqs

How much does an FHA 203k mortgage cover? An enthusiastic FHA 203k loan discusses the purchase price out-of a home, and cost of being qualified fixes. Into the a small 203k, they might be mainly cosmetic and useful upgrades doing $35,000. Basic 203k loans accommodate higher-costs fixes and architectural solutions.

Why does an enthusiastic FHA 203k financing functions? FHA 203k financing works similar to this: You make an application for a loan which have an approved 203k financial. Then you definitely get estimates out of a skilled contractor, obtain the family appraised, and close on your loan. When this occurs, you could start fixes. Those people must be finished within half a year, and then you can transfer to the house.

Who qualifies to possess an FHA 203k financing? In order to qualify for a keen FHA 203k mortgage, you will need no less than an excellent step three.5% downpayment (which have a beneficial 580 credit score or higher). This means 3.5% of your cost and house repair expenses.

The house will additionally need to meet HUD’s minimum property conditions, and that make sure you are purchasing a safe and you can habitable property.

What credit history do you need having an enthusiastic FHA 203k loan? One to depends on your downpayment. With good 580 credit score otherwise a lot more than, minimal down-payment toward any FHA loan try step 3.5%. In case the rating is actually less than 580, you will need an excellent 10% down payment.

Remember that these are simply new minimums set from the FHA. Private lenders can be (and frequently perform) set limits higher than so it. You will need to check with your financing officer observe exactly what credit history minimum you’ll want to see.

Should i do the home improvements me which have an enthusiastic FHA 203k financing? More often than not, you will have to use an authorized specialist to-do the repairs on the an enthusiastic FHA 203k loan. From time to time, you are allowed to Do-it-yourself home improvements, however, on condition that you could potentially establish there is the ability and you can event to do work. Likewise, you can easily however you need prices out of another company. This will be to make sure their offers try appropriate.