Tips Sign up for an enthusiastic FHA Financing during the 5 Strategies

FHA fund was widely available and you may show over twenty-five% of all mortgage loans in the usa. They support a small down-payment out of simply step three.5% and several lenders need individuals which have very low credit scores.

Tips Submit an application for a keen FHA Loan

FHA loans come compliment of very old-fashioned loan providers and you will get an enthusiastic FHA mortgage via your local financial, a large financial company, an online financial otherwise a card relationship. The application form procedure might be comparable for each and every lender.

Preciselywhat are FHA Funds?

FHA funds are mortgages which might be insured because of the FHA (Government Houses Government) enabling having individuals so you can meet the requirements that have a tiny down-payment and you will lower credit ratings. These insured government fund restrict chance towards loan providers that makes FHA loans glamorous to possess lenders provide within its eating plan off mortgage programs available to users.

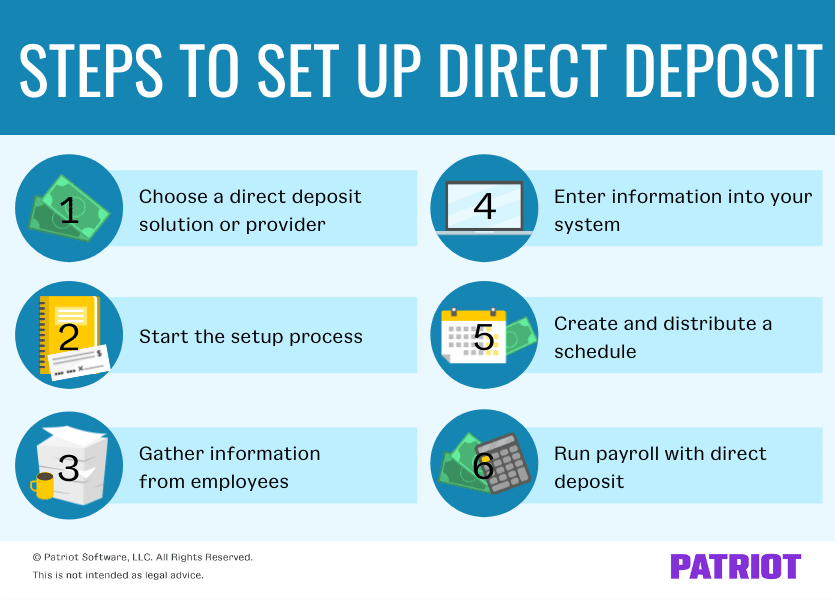

Ideas on how to Apply for a keen FHA Loan in the 5 Steps

Trying to get an FHA loan need but a few simple steps which can be an identical no matter hence lender you decide to utilize.

- Determine your allowance as well as how far you can afford

- Secure rate prices out of several lenders

- Gather duplicates of recent pay stubs, financial statements, and tax returns

- Finish the simple mortgage application form 1003

- Target any additional criteria from your lender

We advice talking-to an enthusiastic FHA bank well before you start selecting a property. This can give you time for you augment people borrowing points or find the downpayment money must intimate in your household financing.

Where you can Submit an application for a keen FHA Loan

The lender options lower than the render FHA money to help you home buyers. But not, they each keeps the masters and need to pick that’s good for you.

step one. Regional Financial Virtually every local lender can give FHA money since there is virtually no exposure in their mind. Inspite of the minimal exposure, local banking institutions have a tendency to wanted higher credit ratings than just nearly all most other bank. They also do not give all FHA loan issues including the FHA 203k treatment financing or perhaps the FHA That Date Intimate framework mortgage.

It is good to seek the advice of your local lender the place you might have your own coupons otherwise bank account observe what they are offering. However, it’s advocated that you get other speed prices.

2. Large financial company Mortgage brokers manage a few direct or wholesale loan providers and have the power to look for a much better deal to your your own part. The average agent are certain to get 2 or three FHA lenders it is confident with therefore the representative commonly choose which bank to help you like when you are balancing the pace capable offer you into percentage they will certainly earn from the financial.

It is critical to observe that using an agent will not suggest you aren’t acquiring the best deal you’ll be able to. Planning to a direct lender doesn’t mean you are reducing the guts guy discover a much better price.

One of several pressures ‘s the agent usually does not have https://paydayloanalabama.com/twin/ lead contact with the latest underwriting service. This makes it more difficult to enable them to force that loan through the acceptance techniques.

step 3. Credit Connection A cards relationship try a non-cash bank which could also allows you to do your first banking with them. They offer mortgages from the competitive costs nonetheless might not accept straight down fico scores.

Of several credit unions require that you registered as a member that may create can cost you otherwise slow down their home loan software process. The program processes can also be defer because of the its lagging technical and you can incapacity to help you publish financial comments or other records electronically.

cuatro. Online Lender Online lenders portray an enormous portion of new mortgage loans into the the united states. Their no. 1 desire is the mortgage providers unlike regional banks that also seeking to offer almost every other products to you in addition to their handmade cards. Without needing practices in almost any area, on the internet have the ability to clean out costs to get really aggressive. Also likely to have the most up to date technical in terms of the application processes.

You’ll find customers just who have a fear of dealing with an online bank because they are discussing private information on the internet. Every lender enjoys an enthusiastic NMLS list which is often confirmed in order to let lose your issues if that’s the truth to you personally.

When you find yourself curious locations to apply for an enthusiastic FHA financing, let us assist you with one to choice. Based upon your own problem and requires, we are able to set you which have an enthusiastic FHA financial that can help. Merely over this consult quotation form and we will get back for you easily.

All are FHA Lenders a similar?

The FHA loan providers won’t be the same as they the has actually her credit rating standards and product offerings that may almost certainly range from, otherwise tend to be limiting than what FHA assistance permit.

Particular loan providers may tell you the financing get standards to possess an enthusiastic FHA financing are 640 like. This means that is the significance of that certain financial.

Brand new FHA enjoys its traditional 203b get financial but they plus has actually most other things like the 203k treatment financing, usually the one-date romantic structure financing and also a keen FHA mortgage to have time efficient home. Of many lenders do not render these special FHA mortgage programs.

Just how to Be eligible for an enthusiastic FHA Mortgage

- Minimal FICO get element 500 down-payment differ

- Minimal down payment dependence on 3.5%

- Financial Top (MIP) is required for each FHA financing

- Limitation loans to help you earnings proportion off 43%

For individuals who see specific otherwise each one of these earliest standards, you might be the ultimate applicant having an enthusiastic FHA mortgage. Understand our very own post on the fresh new FHA loan advice to learn more.