Can i Get a good Virtual assistant Mortgage having a four hundred Credit score?

- Lowvarates Remark –

- USAA Review –

- Experts First-mortgage Evaluations –

Virtual assistant money is a greatest option for experienced and energetic-responsibility provider home buyers for some factors. Also they are liked by loan providers as the the main loan is actually secured thanks to federal support via the U.S. Agencies away from Veterans Circumstances.

However, the bank tend to still have to check that particular monetary requirements was came across whenever deciding whether to accept the mortgage, and one big grounds ‘s the household client’s credit rating. Here we’ll take a look at the minimum requirements of the rating or other contributing issues which is often capable let balance something aside should your homebuyer is actually forgotten the target.

Where Really does a rating regarding five hundred Fall to your Credit Range?

Getting lenders, straight down credit scores was a representation of economic sincerity. In other words, they will be a whole lot more reluctant to issue financing for anyone that have less than perfect credit. A get ranging from three hundred-579 is considered very poor predicated on FICO . The reason being about 62% loans Canton Valley CT off people that have credit scores below 579 will likely end up being surely delinquent, meaning they go more 90 days overdue towards a financial obligation fee subsequently. Yet not, thinking about a score from five-hundred because the 2 hundred factors of being an effective good credit rating and 140 activities off being fair are two an excellent criteria setting.

To reach those individuals benchmarks, homebuyers is always to try to compensate missed costs causing delinquency otherwise standard. For those who have educated a beneficial repossession otherwise foreclosures, while making the right path back again to the top would be a slowly burn off reconstructing their borrowing from the bank reputation of the starting a cycle of on-big date repayments towards the one fund otherwise credit lines you have got discover.

When you have declared personal bankruptcy, rebuilding your credit rating will even need some toes performs. While making consistent payments here once again is best cure for win back debt ground. If time is good, unlock a guaranteed credit card range to let the healing up process to begin. Even though the way to financial healing is generally an arduous travels in some instances, it could be finished step-by-step.

What type of Credit history must Qualify for an excellent Va Loan?

The newest Virtual assistant itself does not set a credit history lowest to help you be eligible for that loan. Essentially, into the a great Virtual assistant financing, home buyers would want to has attained a credit rating out of 580 or more, although this differs from financial so you’re able to bank. Virtual assistant loans do not have chance-mainly based rates customizations, and thus a collector doesn’t set the purchase price or other borrowing from the bank terms in accordance with the household consumer’s danger of nonpayment. Home buyers which have poor credit records generally qualify for quicker positive borrowing terms and conditions than the home buyers that have solid borrowing from the bank histories – it is to aid compensate for the higher chance of default. People which have low scores can get cost exactly like men and women to own high-borrowing individuals.

Will there be Some thing I could Do in order to Mitigate the lowest Borrowing Score When Making an application for good Va Loan?

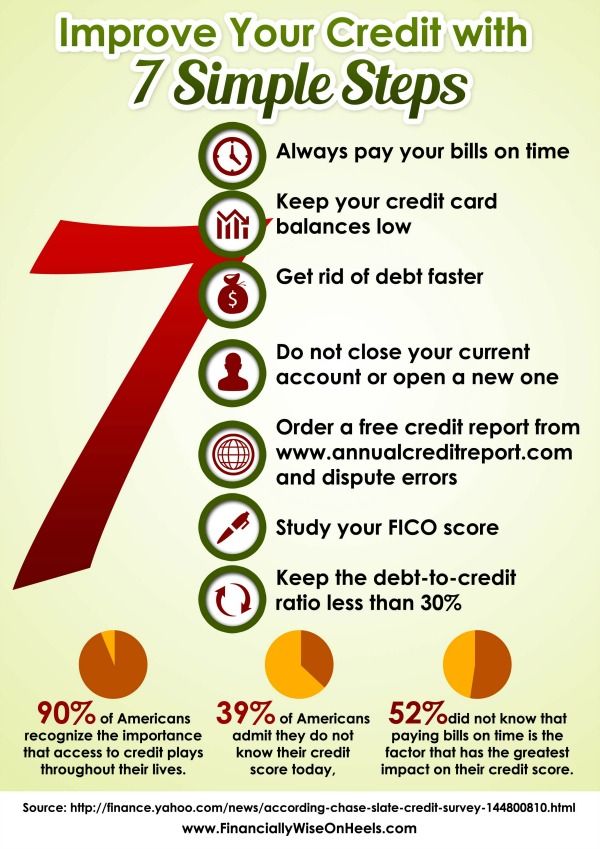

Experienced homebuyers is always to work at their lenders which will make an effective economic course of action in the event that that have a below most useful borrowing get might be an excellent disqualifying basis away from a credit card applicatoin recognition. Take the tips below into account whenever you are looking to boost your loan application attractiveness:

- Suggest to them the bucks. It is possible the correct mix of earnings and you will an excellent more important down payment is also offset and overcome the risks relevant that have poor credit.

- Increase your credit score. This really is one of the most head answers to take care of your own reduced credit rating hassle. Demand a credit report you to definitely lines a financial recuperation initial step to improve your credit rating.

- Get a great co-signer. An effective co-signer is available in useful when they have finest economic history one often qualify for an application. An excellent co-signer assures a lender they’ve the ability to pay back the loan loan whether your top debtor non-payments. Understand that towards the an effective Virtual assistant financing, this new Va requires the co-signer becoming a partner or any other eligible military provider associate.

- Manage your debt-to-money ratio (DTI). Your DTI is actually an indicator that lender uses determine your capability to handle settling the monthly installments. Buy a beneficial DTI from 43% to gain your own lender’s recognition with the a software.

Lastly, if you find yourself a beneficial Va otherwise military-services associate looking to purchase a home and your application for the loan will get refused, the lender will give you an adverse step see. That it observe traces people monetary shortage which are often blocking you off qualifying for a loan.

This equipment is even a valuable asset, tiered to provide you with an easy way to climb away from financial delinquency. Occasionally, it can be used in order to dispute the precision otherwise completeness out-of one information provided by the credit revealing agency that may be blocking you from qualifying for a financial loan. Demonstrably, if you have a minimal credit history, remain peaceful or take command over your situation through an excellent financial plan of action.

How do Character Loan Help you?

The pros, armed forces solution users, and their parents are entitled to a financing provider that will see these with an equivalent level of hobbies and efforts it displayed in their desire in order to suffice this country.

Hero Mortgage was designed to render seasoned home buyers, as well as their family which have an easy, painless and you may personalized credit service who does assist them to qualify for that loan to acquire the home of the desires. The audience is proud to support pros during the a lending strength as the well because exhibiting our very own admiration of the supporting veteran-possessed enterprises and occurrences. The audience is along with pleased supply right back from efforts away from the new Fisher Domestic Basis, a project providing you with back again to pros, and their family by giving free of charge construction to own pros otherwise active-service military members in the process of treatments.

Our team out of friendly lending professionals explore a face-to-face method to focus on all of our customers and get a monetary services that suits their residence to find demands. Hero Loan’s elite and you can effective functions can help our very own website subscribers qualify for a loan within just five minutes*, which have closure periods within two weeks. We could improve the new underwriting process inside the-house which provides the domestic consumer an expedited application for the loan control day. Moreover it allows us to take on records that can end up being challenging.

Call us now during the (866) 222-0219 to speak with an excellent Virtual assistant loan associate who will meet your at your economic location predicated on your existing credit history and other important monetary ideas. You can even reach out to one of the credit experts, due to the alive chat solution to get a sense of your own Virtual assistant home loan qualification now.