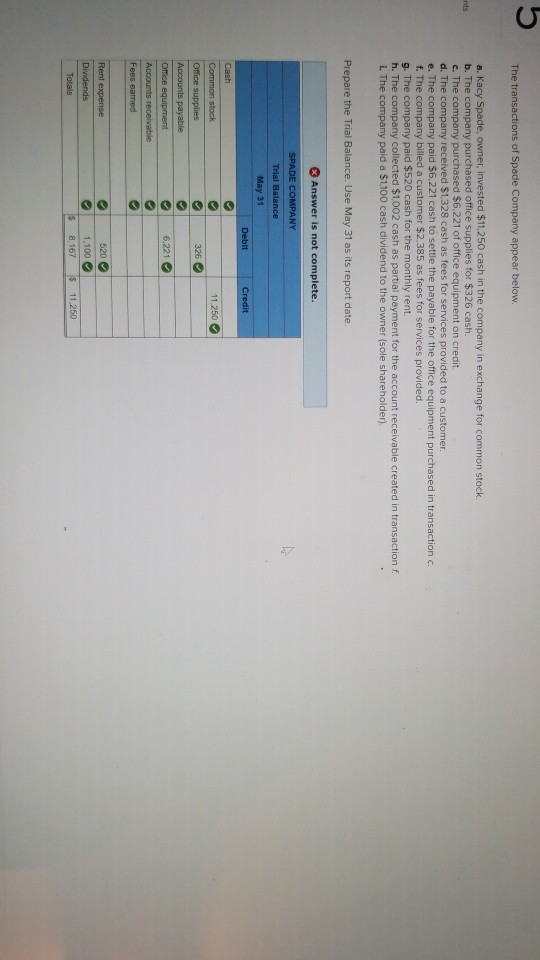

Debt consolidation: Financial Refinance Options and Faq’s From the Refinancing to help you Consolidate Loans

Of many property owners re-finance their mortgage loans to lessen their interest rates or clean out the monthly payments. Anyone else re-finance so you’re able to make use of the newest guarantee they will have founded and turn into one to guarantee on the dollars they’re able to use.

An alternative choice which had been a lifetime-saver for the majority of homeowners pertains to a combination regarding most other debts. That’s, incorporating most other costs such as for example handmade cards, personal loans, and you may automotive loans, together with your present mortgage on the a new home loan. All those monthly payments is actually folded on the one.

You can not only always beat most other large-notice profile into a lesser rates home mortgage, nevertheless incorporation of the many those people brief profile into good long term home loan can cause sudden and you can remarkable decrease on the month-to-month obligations money – resulting in really instant relief.

Would you like to find out more about merging the money you owe that have a mortgage re-finance? This is what you must know earliest.

Easing the fresh monthly load

Expenses are a lot for example weeds. Whilst you aren’t attending to, they appear to keep expanding, up until one-day you appear down, and cannot see your legs any further. Obligations, especially credit card debt will just continue to proliferate up to i view it more and more difficult to help make the monthly installments any further. Or select we are able to only spend the money for minimum.

You to cure for you to definitely state should be to merge people most other balance and you will outlay cash out of with a debt settlement mortgage re-finance. It will provide you with a different sort of home mortgage that have a good high equilibrium, and you may a fees greater than your old home mortgage. However it will also remove the newest several monthly installments for everybody the individuals financing you are combining, leaving you with just the one this new homeloan payment.

The consequence of that will be, in some instances, month-to-month offers in the several, also several thousand dollars. Of course, the impression of debt consolidating could well be book inside for each and every circumstances, different from borrower to another location.

Cutting interest weight

You’ve seen the current headlines. Financial pricing has reached historic lows now, while assets thinking is near most of the-day highs. It means it might be very likely you will have the greatest standards for making use of the brand new available guarantee on your own assets to https://cashadvancecompass.com/installment-loans-me/ repay funds and you may playing cards which have higher prices out of notice.

- Refinance your current mortgage into the more substantial-size of you to thru a finances-out refinance. Bring your existing balance, include the fresh balances of your own higher-desire debts, that’s just how much you should aim to take out to combine your financial situation.

- When you close in your loan, teach your lender to repay those individuals almost every other stability on your own account. When you pay-off the individuals most other balance in full, then only monthly loans remaining will probably be your the newest financial fee.

- Shell out your own financial monthly, exactly as you did before. The newest homeloan payment should be greater than the outdated one to, however your overall loans solution could be very far improved.

Other reason a debt settlement financial might possibly be a great selection

Also lowering your month-to-month financial obligation solution, and also the possibility reducing the interest rates of your most other costs, there are many reason why a debt consolidation re-finance can work for you.

step 1. Taxes

Mortgage loans come with yet another taxation benefit you won’t look for together with other style of expenses: the interest often is allowable from your annual taxation statements. As long as you itemize deductions on your production, you can discount particular otherwise most of the desire you shell out from year to year on your own financial. But every person’s activities was unique, and regulate how a lot of good results this is to you, it’s always best to consult a tax elite group who’ll render your sensible income tax information.