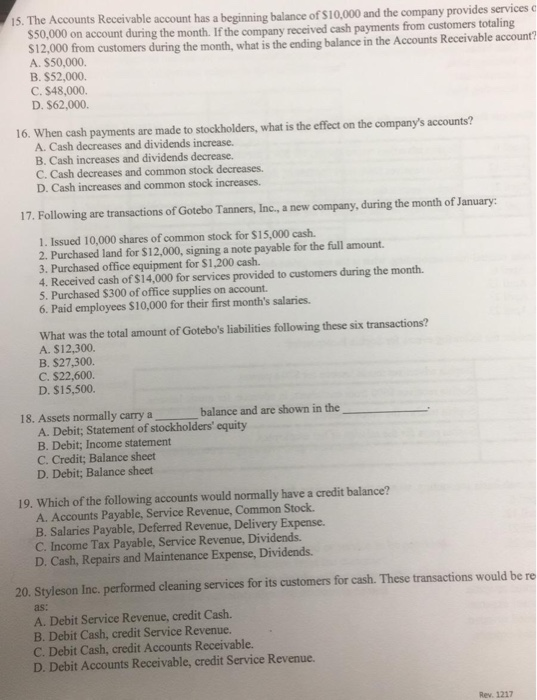

Finest Personal loans Out-of Finest Loan providers inside

Mortgage Identity Revelation

The loan terms and conditions, including ount, label duration, and your borrowing from the bank reputation. Expert borrowing from the bank must be eligible for reduced pricing. Rates are cited which have AutoPay write off. AutoPay disregard is just available just before financing investment. Costs without AutoPay are 0.50% products high. Susceptible to credit acceptance. Criteria and you can limits use. Said rates and you may terms is actually subject to change without warning. Commission example: Monthly obligations to own an effective $twenty-five,000 financing during the 7.49% Annual percentage rate with a term regarding 3 years do cause thirty six monthly premiums from $. 2024 Truist Economic Business. Truist, LightStream therefore the LightStream https://paydayloancolorado.net/colona/ icon was services scratching of Truist Economic Company. All other trademarks could be the assets of their respective citizens. Financing services available with Truist Financial.

Costs Disclosure

Repaired pricing out-of 8.99% Annual percentage rate in order to % Annual percentage rate reflect new 0.25% autopay interest rate dismiss and an effective 0.25% direct deposit interest rate disregard. SoFi price ranges is actually most recent by and therefore are subject to transform without warning. An average from SoFi Signature loans funded from inside the 2022 was to $30K. Not absolutely all individuals qualify for a decreased price. Lower pricing kepted for the most creditworthy individuals. Their real price might possibly be in list of rates listed and certainly will trust the word you choose, research of creditworthiness, money, and you will some other variables. Loan quantity vary from $5,000 $100,000. The latest Annual percentage rate ‘s the price of borrowing from the bank while the a yearly price and you can reflects one another their interest rate and you will an origination payment from 0%-7%, which can be deducted from any loan continues you will get. Autopay: New SoFi 0.25% autopay interest rate avoidance need you to invest in create month-to-month dominant and desire payments by an automated month-to-month deduction regarding a beneficial offers otherwise family savings. The main benefit often cease and get lost to possess periods where you don’t shell out by automatic deduction away from a discount or bank account. Autopay isn’t needed for financing regarding SoFi. Lead Put Write off: Are permitted possibly discover a supplementary (0.25%) interest avoidance for setting-up head put which have good SoFi Examining and you may Family savings given by SoFi Lender, Letter.Good. or qualified cash government account supplied by SoFi Bonds, LLC (Direct Put Account), you truly need to have an unbarred Lead Deposit Membership inside thirty days of your funding of your own Financing. Once qualified, you’ll receive it discount while in the attacks where you keeps permitted payroll lead dumps with a minimum of $1,000/times so you’re able to a direct Deposit Account relative to SoFi’s practical measures and requires to-be calculated in the SoFi’s best discernment. It discount was lost during the attacks where SoFi identifies you’ve got deterred direct places towards Direct Deposit Account. You aren’t required to subscribe lead deposits to get that loan.

Arrive at Financial: Best for consolidating obligations fast

- Financing available to your creditors in 24 hours or less of financing acceptance

- Accessibility your free monthly credit rating

- A few of the lowest undertaking rates in the business

- Finance can simply be used to have combining obligations

- Can charge an upfront origination payment

- Can not sign up for that loan having another individual

What to know

Reach Monetary now offers unsecured loans created specifically getting debt consolidating and bank card refinancing. Their performing cost are aggressive, and you can Reach delivers the cash for the financial institutions within 24 hours away from loan acceptance. you will score totally free month-to-month entry to your credit score.

You can save cash on the loan for individuals who be eligible for Reach’s lowest doing costs, but be looking to own a keen origination fee – Come to charge doing 8.00% of your own loan amount at the start.