Owning a home would need to wait a little for this DACA individual

Display it:

Rodrigo Mendoza, thirty-two, has just revealed he had been pre-acknowledged to own a property mortgage however, his intends to individual a good house are on hold since DACA will be repealed in Temecula Wednesday, . (Honest Bellino, Brand new Drive-Enterprise/SCNG)

Rodrigo Mendoza, thirty-two, (center) features restaurants on his family home inside Temecula, Mendoza recently realized he had been pre-acknowledged getting property financing but their plans to individual good household take keep since DACA will be repealed. Wednesday, . (Honest Bellino, The fresh Force-Enterprise/SCNG)

Rodrigo Mendoza, 32, has just learned he had been pre-accepted for a home loan but their intentions to own a household take keep since DACA is repealed within the Temecula Wednesday, . (Honest Bellino, The latest Push-Enterprise/SCNG)

Rodrigo Mendoza worked full-time once the a pipeline layer to own number of years, enough to build their credit to invest in his first family.

Mendoza, thirty-two, regarding Temecula, are a person about Deferred Action having Youngsters Arrivals, or DACA, system who has given a couple-year sustainable functions permits and deportation save to help you on the 800,000 younger immigrants nationwide.

The fresh Obama-point in time system, as the revealed Sept. 5, is eliminated in the next six months, disrupting tomorrow preparations out of Mendoza or any other DACA recipients which make financial strides under this program.

Which had been one of my personal greatest goals, purchasing my personal house, Mendoza told you. Immediately, I do not should do they. I’d rather waiting observe what will happen.

This new short-term DACA program, and therefore Obama enacted for the 2012 as an executive purchase, acceptance people who arrived in the us in advance of years sixteen, and exactly who satisfied specific almost every other requirements, to get Personal Safeguards amounts and defer deportation.

Less than DACA, thousands of younger immigrants experienced the opportunity to visit school, pick residential property and you will follow promising professions.

A separate statement led because of the UC Hillcrest professor Tom K. Wong suggests that DACA beneficiaries make tall benefits with the cost savings of the earning higher earnings, to purchase trucks and purchasing land.

The study, and that interviewed step 3,063 DACA readers when you look at the 46 claims, found that 69 % regarding respondents stated thinking of moving employment having best pay. The common every hour wage out-of users improved by 69 percent once the getting DACA, ascending away from $ to $.

And nearly 65 per cent said to acquire the earliest auto, when you find yourself 23 percent away from participants twenty five or old claimed buying good family, depending on the analysis released from inside the late August.

Undocumented immigrants, not, do not require DACA to invest in property. They are able to availableness mortgage loans the help of its income tax character wide variety, said Erick Sosa, a mortgage loan administrator from inside the Corona. They just you desire extra cash beforehand, he told you.

Which are problems since the DACA beneficiaries may be a great deal more reluctant to spend some money if their job problem try uncertain.

Giovanni Peri, teacher of economics at the UC Davis, said the guy anticipates some DACA beneficiaries is annoyed from tapping their offers.

Broker Jairo Arreola, which takes care of this new DACA Financial Myspace web page, has just started a paign to aware DACA beneficiaries they may be able nevertheless qualify for mortgage brokers.

Arreola pre-microsoft windows prospects, checking credit and work record, then ahead these to a fund service nonetheless lending to help you DACA recipients.

Arreola, that is based in Northern Ca, said of several beneficiaries of program is cautious because they do not wish to be caught that have home financing if there is zero legislative develop because program was phased out.

Owning a home would have to wait for this DACA person

About today, it is possible to rating one thing, Arreola told you. Poor situation circumstance, you might have to sell it, however, meanwhile you might be capable of getting particular security.

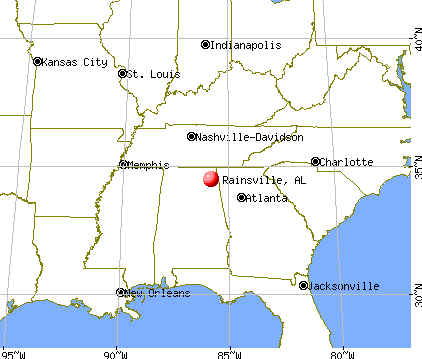

The guy said he isn’t concerned with looking operate just after his enable ends second November. Inside the arena of performs, not https://paydayloanalabama.com/waterloo/ absolutely all businesses require works agreement, he told you.

Exactly what issues him ‘s the likelihood of deportation. The cash the guy throws inside due to the fact a deposit carry out wade to help you waste in the event the he is deported, the guy told you.